Unlocking India's Air Cargo Potential: Untapped Support Sectors Driving Future Growth

5 mins. read | 8th April 2025

India’s air cargo sector is poised for transformative growth and positioning as a leading global logistics hub, with the goal set by India’s National Aviation Policy to achieve a cargo volume of up to 10 MTPA by 2030. As we enter fiscal year 2025, the focus is shifting beyond just expanding airport capacity and fleet sizes to untapped support sectors such as regulatory reforms, cutting-edge logistics technologies, domestic Maintenance, Repair, and Overhaul (MRO) services, cold chain solutions, and sustainable practices to accelerate India’s air cargo industry to new heights, bringing us closer to the ambitious targets outlined for the nation.

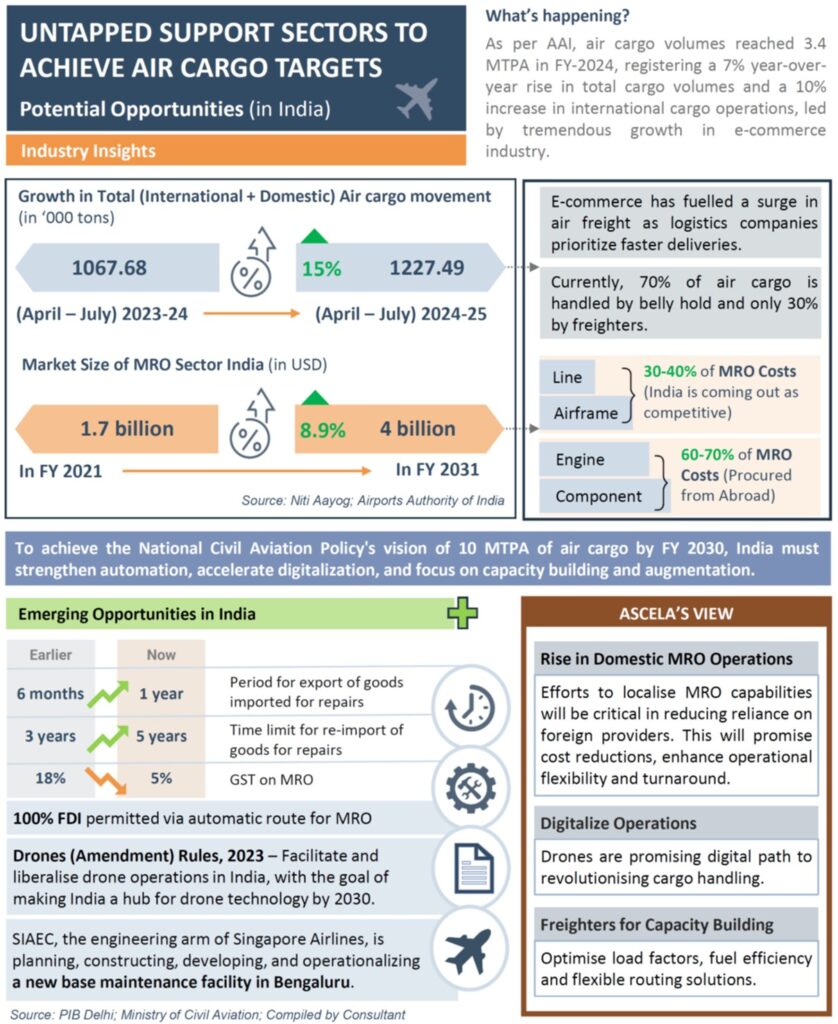

The growth trajectory for India’s air cargo sector is already apparent. According to the Airports Authority of India (AAI), air cargo volumes in FY 2024 surged to 3.4 MTPA, marking a 7% year-over-year increase in overall cargo volumes and a 10% rise in international cargo operations.

Much of this growth has been driven by the rapid expansion of e-commerce, which has created a heightened demand for faster, more efficient delivery solutions. In fact, between April and October 2024, India’s air cargo sector experienced a remarkable 19.9% growth in international cargo, 7.8% growth in domestic cargo, and an overall 15% growth in cargo tonnage across the country compared to the same period in 2023.

However, while the sector is expanding rapidly, several structural challenges still hinder its full potential. A key obstacle is the reliance on belly hold capacity for air cargo; approximately 70% of air cargo is transported in passenger aircraft holds, and only 30% is handled by dedicated freighters. This imbalance presents a significant limitation, as the belly-hold capacity of passenger planes is insufficient to meet the growing demand for air freight, particularly with the rise in global trade and e-commerce shipments.

Another pressing challenge is the limited availability of domestic MRO services. India’s MRO market is forecasted to grow from USD 1.7 billion in FY 2021 to USD 4 billion by FY 2031, with an annual growth rate of 8.9%. Despite this positive growth, about 30-40% of MRO costs relate to airframe and line maintenance, where India remains competitive. However, a significant portion, 60-70% of MRO costs relates to engines and components, which are still imported mainly due to the absence of comprehensive domestic MRO capabilities.

Regulatory reforms are already underway, and as they take shape, the industry will see streamlined processes, enhanced coordination, and more efficient customs procedures. However, it is clear that the growth of India’s air cargo sector will depend on improving infrastructure and a strategic alignment of support sectors that can address the sector’s challenges from the ground up.

Emerging Opportunities in India

Policy Shifts and Regulatory Reforms

Regulatory reforms in India’s aviation sector are significantly enhancing the efficiency of air cargo logistics, propelling the industry toward more significant growth. In the Union Budget 2024-25, several key announcements were made to streamline processes and reduce barriers for businesses engaged in air cargo operations.

Extending export timelines for goods under repair, re-importing goods for repair, and the new uniform 5% IGST on aircraft parts and components simplify the tax structure. In comparison, 100% FDI in MRO activities boosts investment in domestic services. The government’s focus on improving e-commerce services, which aims for faster customs clearance with the surge seen in online shopping, enables rapid delivery systems crucial for the sector’s growth. By reducing regulatory complexity, improving tax structures, and fostering investment, India is poised to become a global leader in air cargo logistics, driven by innovation, efficiency, and enhanced connectivity.

Infrastructure and Technological Advancements

India’s air cargo infrastructure has undergone significant enhancements in recent years. Major airports like Delhi, Mumbai, and Bengaluru have invested in state-of-the-art dedicated cargo terminals and automated handling systems, improving operational efficiency and reducing transit times. Integrating advanced tracking technologies and logistics platforms is revolutionizing cargo management, increasing visibility and coordination.

As e-commerce demand grows, India also focuses on improving last-mile delivery capabilities, incorporating technologies like drones. The Drones (Amendment) Rules, 2023, are designed to facilitate drone operations and position India as a hub for drone technology by 2030.

India is also enhancing its cold chain logistics infrastructure, which is crucial for transporting perishables, pharmaceuticals, and high-value electronics. The government is investing in refrigerated warehouses and specialized air cargo facilities to meet the growing need for temperature-sensitive goods, especially in the post-COVID era.

Enhancing Global Connectivity and Sustainability

India’s recent Open Sky Policy revision has established air cargo agreements with 24 countries, improving connectivity and reducing delivery times for Indian exporters. AAICLAS has commenced international cargo operations in several cities, boosting global access for India’s exporters.

Strengthening domestic MRO capabilities is also critical to India’s air cargo strategy. Air India has partnered with Singapore Airlines Engineering Company (SIAEC) to develop a new base maintenance facility in Bengaluru to improve India’s MRO infrastructure and reduce dependence on foreign service providers.

Sustainability is becoming a priority for the air cargo industry. The Ministry of Civil Aviation has launched initiatives to develop working groups to advance Sustainable Aviation Fuel (SAF) and promote carbon market development. Leading companies like GMR Airports and SpiceJet are already implementing green solutions, and India is positioning itself to lead in sustainable air cargo practices.

A Bright Future for India's Air Cargo Sector

To achieve the National Civil Aviation Policy’s vision of 10 MTPA of air cargo volume by FY 2030, India must strengthen automation, accelerate digitalization, and focus on capacity building and augmentation by tapping into the support sectors of aviation.

India’s air cargo sector is on the cusp of a significant transformation fueled by strategic investments. The trends and policy shifts highlight a clear trajectory toward more efficient, sustainable, and globally integrated air cargo operations. The untapped support sectors, logistics technology, domestic MRO facilities, cold chain solutions, and regulatory improvements have the potential to drive this change, positioning India’s air cargo industry to become a major player in the global logistics ecosystem.

To overcome the hurdles, ASCELA stresses the need for continued investment in infrastructure, domestic MRO operations, greater integration of digital paths like drones, and faster adoption of global best practices. Companies in the air cargo space must also focus on developing specialized services that cater to niche markets such as high-value goods, perishables, and pharmaceuticals. Also, companies should focus on optimizing load factors’ fuel efficiency and developing flexible routing solutions by employing dedicated freighters for capacity building.

For stakeholders in the industry, the message is clear: the time to act is now. By embracing innovation and sustainable practices in the support sectors, the Indian air cargo sector can unlock its full potential and help India achieve its future ambitious trade and economic goals.

At ASCELA, we are committed to guiding businesses through this transformation, leveraging our logistics, infrastructure, and strategic development expertise. By promoting innovation, collaboration, and sustainability, we aim to accelerate India’s air cargo sector toward a more innovative, more efficient, and globally integrated future.

Author:

Ayushi Gupta

Consultant

Strategic Advisory- Mobility and Supply Chain

Share via: